Wealth Management and Financial Planning M&A

MarktoMarket analyses the deal values, multiples and discounts in the wealth management and financial planning industries.

CHARLES STANLEY SUCCUMBS

The acquisition of Charles Stanley by Raymond James is the latest high-profile deal in the wealth management space. After nearly 200 years of independence, the Sheffield-based private client business was delisted following a successful £279 million bid. Earlier in the year, Intermediate Capital, the mezzanine debt investor, teamed up with IK Investment Partners to acquire Formue, a Norwegian private client business with operations in London, for £250 million. Trumping both of these transactions was Lloyd’s £380 million acquisition of Embark Group, the retirement solutions specialist.

There are a number of factors driving M&A activity in the wealth space. The attractions of a long-term, recurring revenue model are apparent to private equity consolidators, and the benefits of operational leverage have alerted trade players to the rewards of inorganic growth. Beyond the obvious benefit of consolidation, namely cost rationalisation, some operators have broader strategic objectives – Mattioli Woods’ acquisition ethos is one of vertical integration to deliver a low-cost, holistic client proposition from financial planning through to wealth advice and, finally, in-house fund management.

The industry is not, however, immune to challenges. Fee pressure is becoming acute as the battle between passive and active fund management rages and this is filtering down into wealth and financial planning as clients seek to drive down ‘all in’ fees. Regulation is also likely to continue in one direction, putting pressure on smaller operators to comply and further exacerbating margin pressures.

bidding wars

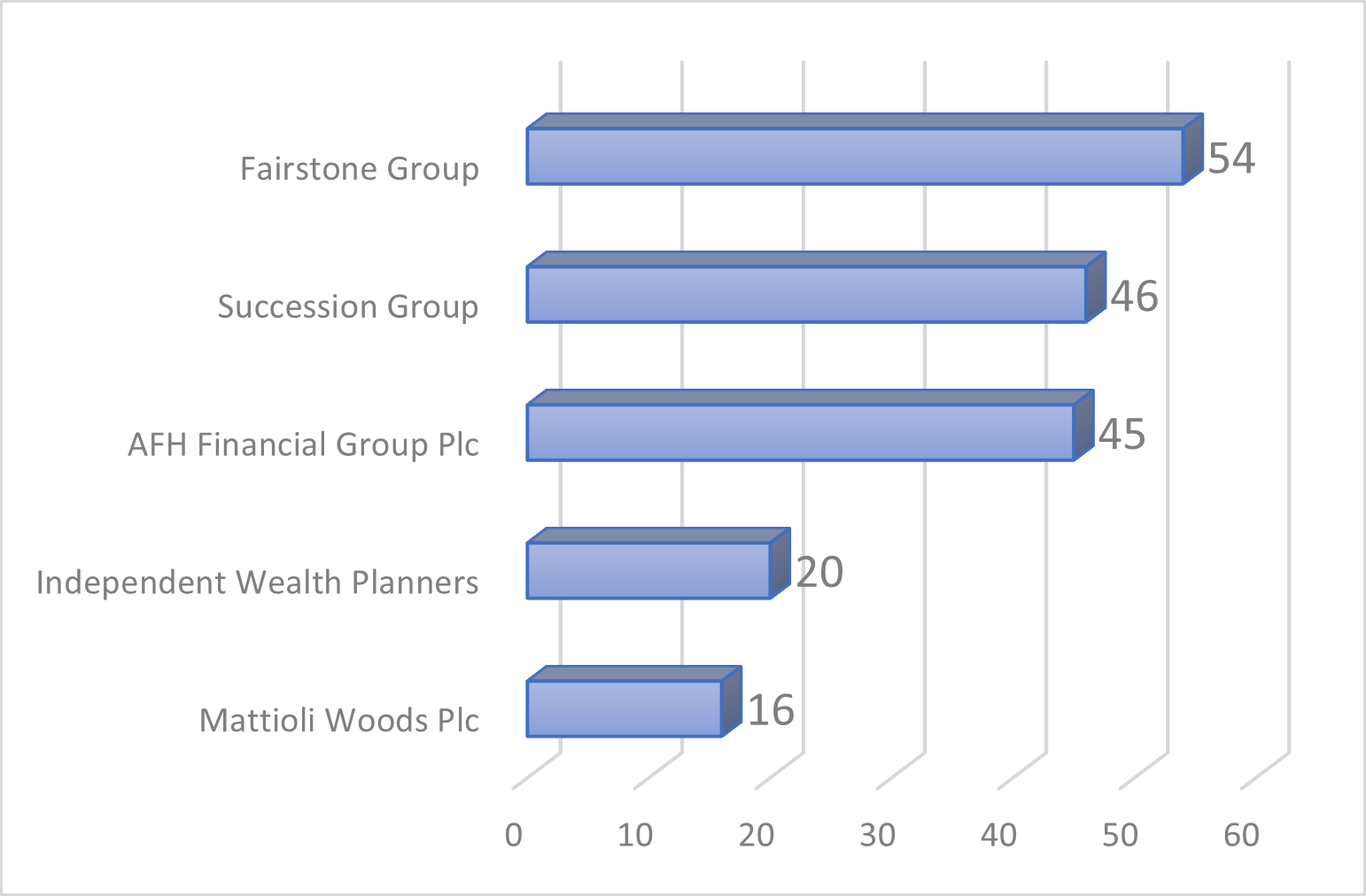

Fairstone leads the way with acquisition activity, completing an astonishing 54 deals since 2017. In March the group received a significant investment from TA Associates, the US private equity investor, alongside existing investors Synova and Alcentra, providing access to more acquisition capital. Not far behind Fairstone is Succession Group with 46 deals. With capital from Inflexion and Ares, Succession has built a group that now boasts 600 staff and over 17,000 clients.

A buyer that has avoided private equity and instead used its AIM-listed paper as currency for acquisitions is AFH Financial Group. A series of fundraises facilitated the completion of 45 deals since 2015. Poacher turned gamekeeper earlier this year when AFH was itself the subject of a £231 million takeover by Flexpoint Ford, the New York-based buyout group, demonstrating the attractiveness of these assets to overseas, as well as domestic, buyers.

Independent Wealth Planners (IWP) has recorded the acquisition of 20 planning and wealth management businesses. Unlike traditional consolidators, IWP eschews control over acquired businesses, instead retaining the vendors to run their businesses as directly authorised firms. Other active buyers include Mattioli Woods, Old Mutual and Standard Life. We expect new entrant Truinvest, which surpassed £1 billion in assets under management earlier this year, to provide further competition.

Most active buyers: 2015 to present

valuations

The median multiple paid in our sample is just shy of 4x revenues. Size is a factor in determining pricing and multiples appear to have been trending up, reflecting the increased competition for assets across the deal size spectrum.

Whilst our mapping of the owner-managed wealth and planning market suggests that there remain a plethora of owner-managed assets for buyers to go for, vendors appear to be taking advantage of competitive tension to push-up prices. This is reducing opportunities for valuation arbitrage, where participants can buy small businesses on modest multiples before selling the large business that results for a higher multiple. However, with the cost of capital remaining low and a growing need for wealth management services due to pension reforms, rising life expectancies and clamp-downs in alternatives such as buy-to-let, there remains money to be made.

MARKTOMARKET

MarktoMarket collects data on private capital market activity in the UK.

For more details on these deals and MarktoMarket’s broader datasets please contact doug@marktomarket.io.