UK M&A H1 2022 Valuation Indices

report Highlights

Highlights from our H1 2022 UK M&A Valuation Indices, covering UK M&A transaction multiples for M&A deals completed in January – June 2022.

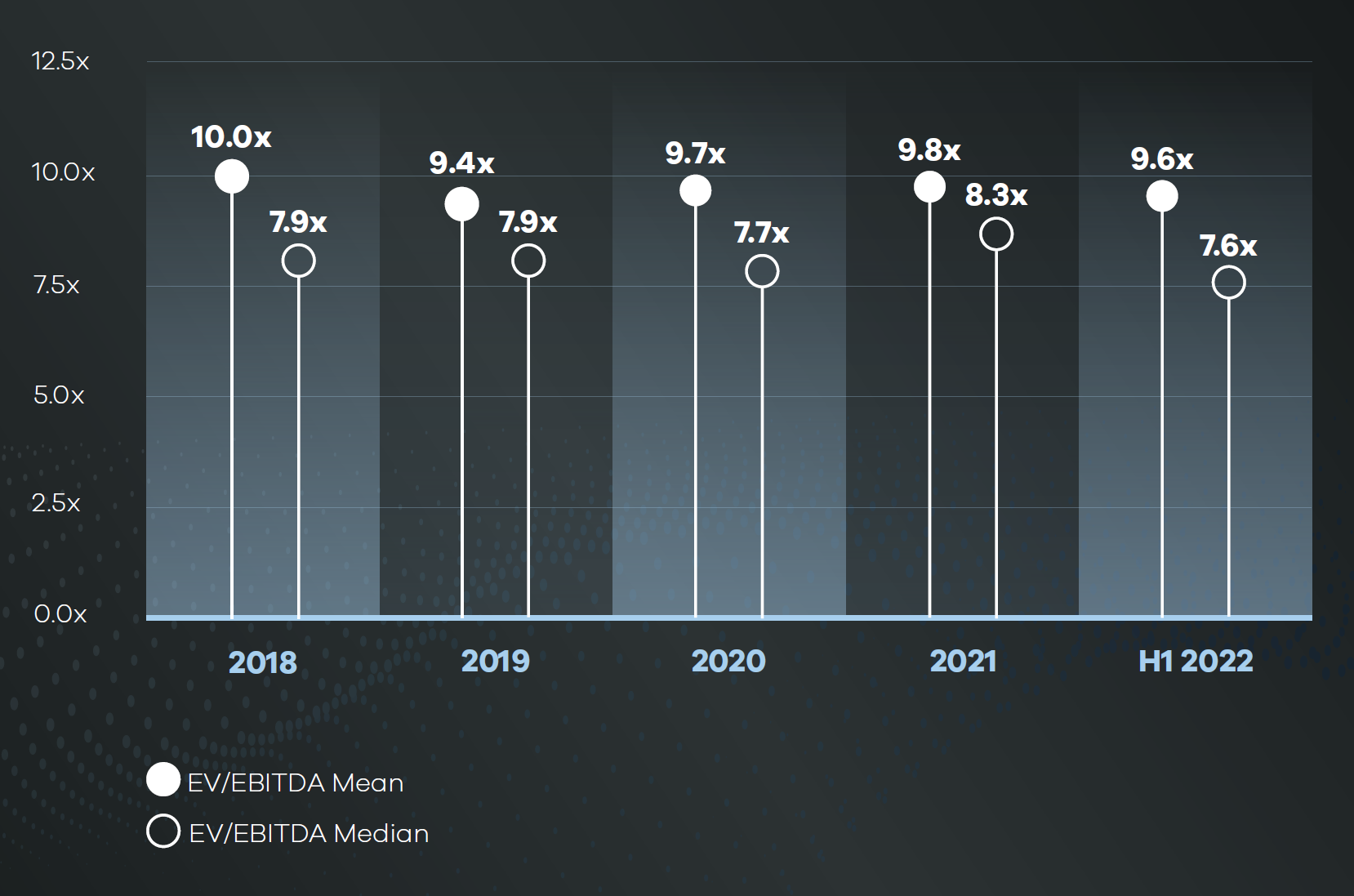

The deal market entered 2022 in a strong position until global political tensions increased over Russia’s invasion of Ukraine. The resultant economic impacts from the conflict – high energy prices, inflationary pressures and interest rate increases – have created a feeling of market uncertainty in recent times. This combination of factors has fed through to a decline in the MarktoMarket All Cap Index relative to 2021 when measured by median Enterprise Value to EBITDA (EV/EBITDA).

All Cap Sub-£250m Index EBITDA Multiple

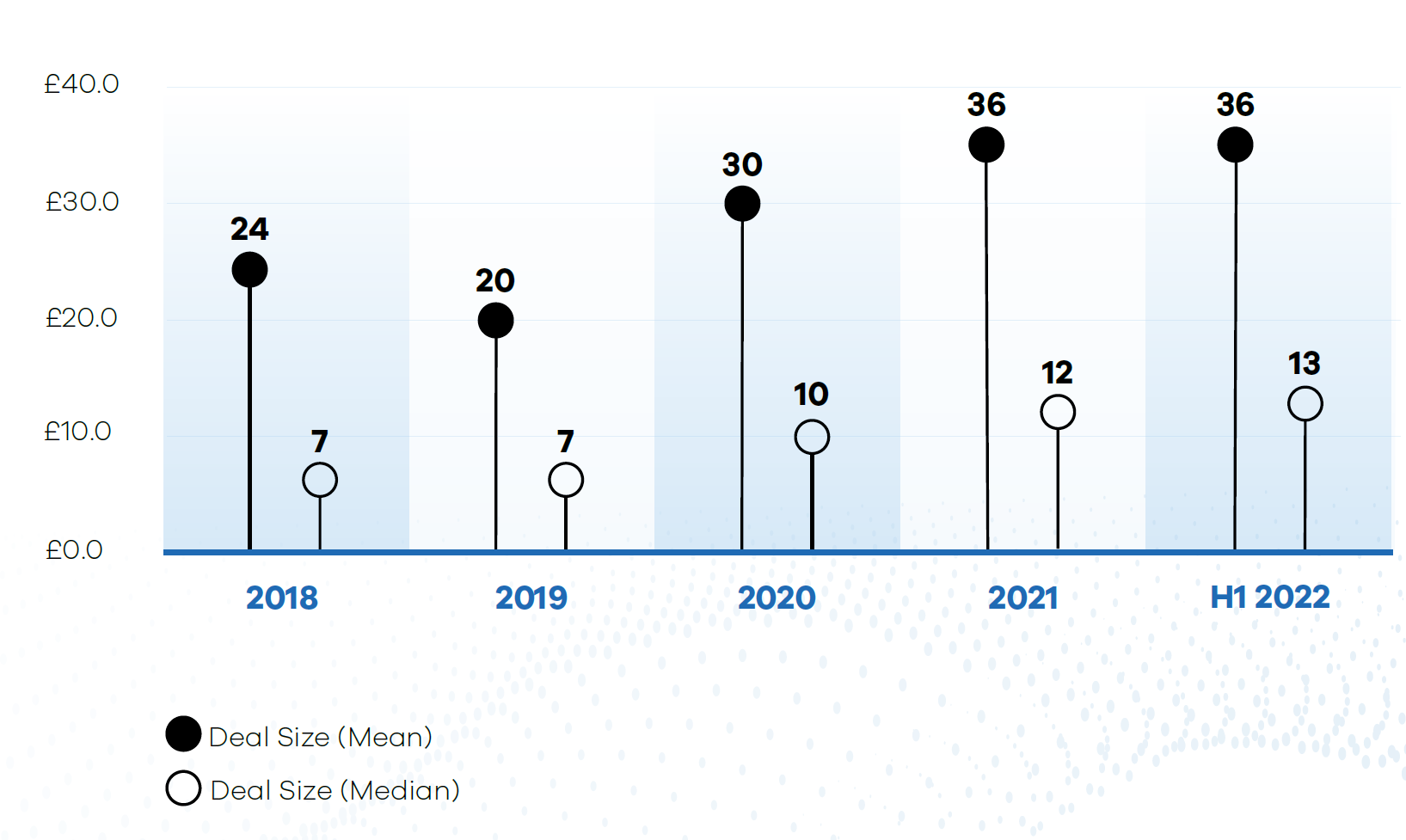

Deal volumes have remained buoyant in H1 2022 with only a slight reduction of 6.5% compared to H1 2021 (which will lessen as we uncover more deals in this period).

Please note that the chart implies only the movement in deal values within our datasets that feed into these indices and not necessarily the average deal value movement across the entire market.

Size Based Indices

All Cap Sub-£250m Index Deal Size (£m)

In addition to the MtM All Cap Index (all deals under £250 million), we present five size indices in our report including the Nano Cap Index, which consists of M&A transactions valued at under £2.5m. Our provisional data suggests that EBITDA multiples in sales of businesses valued at under £2.5 million increased in H1 2022 relative to 2021, moving back into line with 2020 EBITDA multiples of 4.7x.

SECTOR-BASED INDICES

Within sectors, The Technology, Media& Telecommunications (TMT) Index continues to demonstrate a significant valuation premium over both the Consumer and Industrials & Business Support Services (I&BSS) Indices.

Request the executive report below. Please contact olga@marktomarket.io to discuss access to the full versions of all MarktoMarket Reports.

For the full list of previous reports visit our reports page.

Request the Report

Submit the form for the executive report.