UK M&A 2023 Valuation Indices Full Report

report Highlights

Highlights from our 2023 UK M&A Valuation Indices, covering UK M&A transaction multiples for M&A deals completed in January – December 2023.

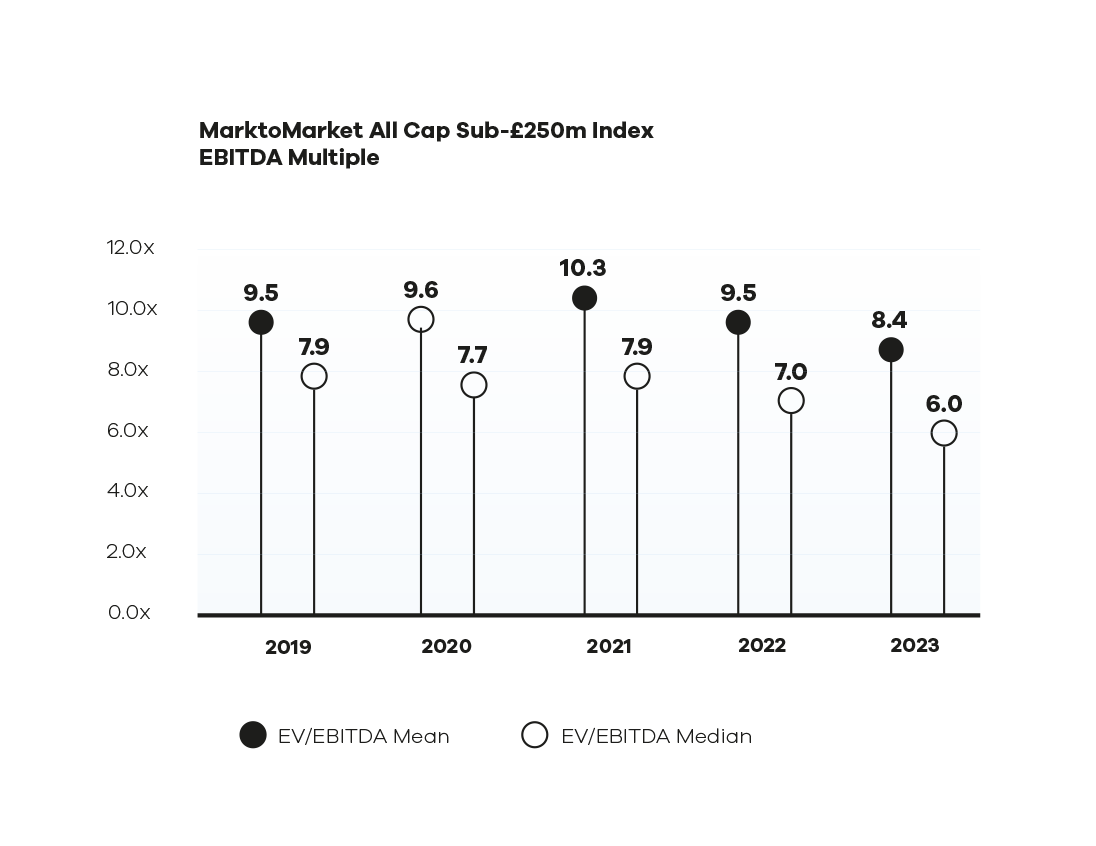

The fall in the MarktoMarket All-Cap Index, encompassing data from deals below an enterprise value of £250 million, continued into 2023. The median Enterprise Value to EBITDA (EV/EBITDA) multiple paid during the year, excluding outliers, was 6.0x. The comparison for 2022 was 7.0x**.

In addition to the MtM All Cap Index (all deals under £250 million), we present five size indices. This is in order to help our customers understand, justify and defend size-related discounts and premia.

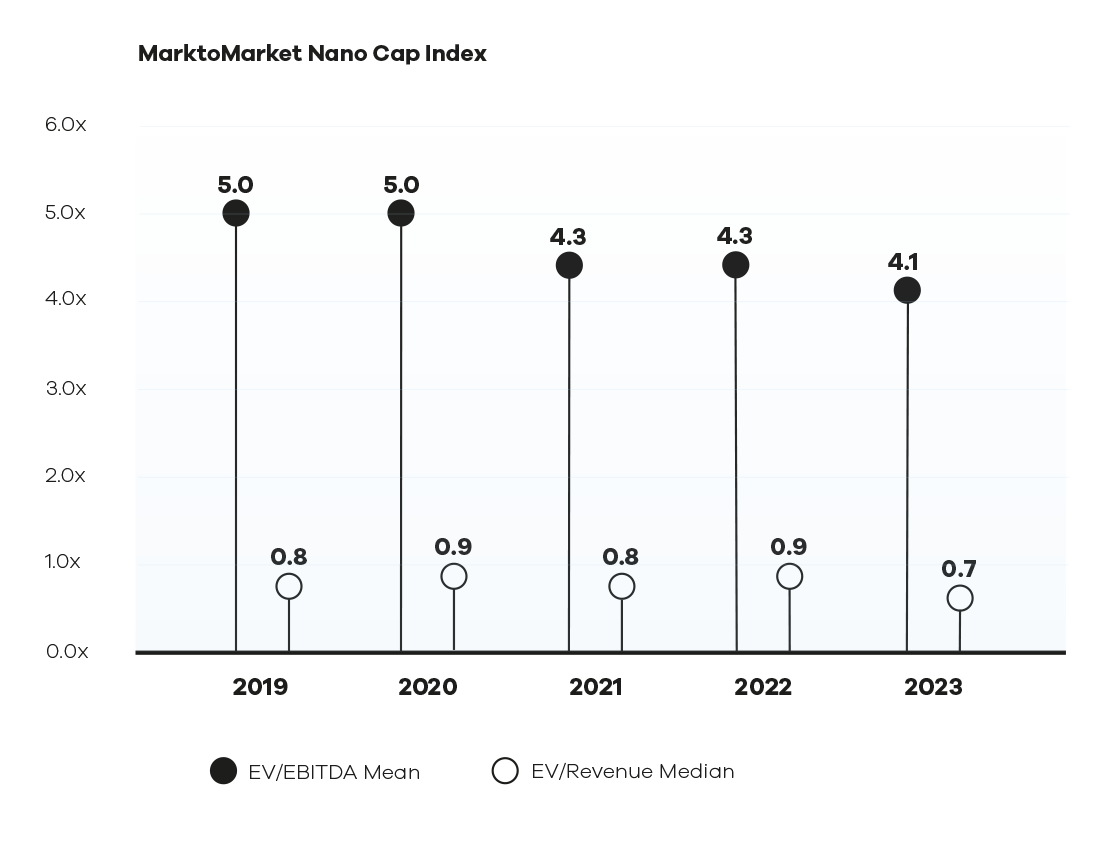

The Nano-Cap index, which consists of M&A transactions valued at under £2.5m, is designed to be representative of the smallest companies in the UK. Due to the limited disclosure requirements imposed upon the UK’s smallest private companies, information is sparse. However, MarktoMarket’s technology and in-house research team, alongside contributions

from our customers, allow us to create an index for these tiny companies.

Our data suggests that the EV/EBITDA multiple in the Nano-Cap index fell slightly when compared to last year. Given movements in other indices, this resilience in pricing amongst the UK’s smallest companies is surprising but, perhaps, indicative of different dynamics at this end of the market. It is also telling that multiples remain some way off the highs of 2019 and 2022.

SECTOR-BASED INDICES

Within sectors, The Technology, Media& Telecommunications (TMT) Index continues to demonstrate a significant valuation premium over both the Consumer and Industrials & Business Support Services (I&BSS) Indices.

Request the executive report below. Please contact olga@marktomarket.io to discuss access to the full versions of all MarktoMarket Reports.

For the full list of previous reports visit our reports page.

Request the Report

Submit the form for the executive report.