December 2022 Valuation Barometer

OVERVIEW

Highlights from our December 2022 Valuation Barometer, covering deals and valuation multiples in UK M&A in November 2022. Request the Executive Summary below.

HIGHLIGHTS

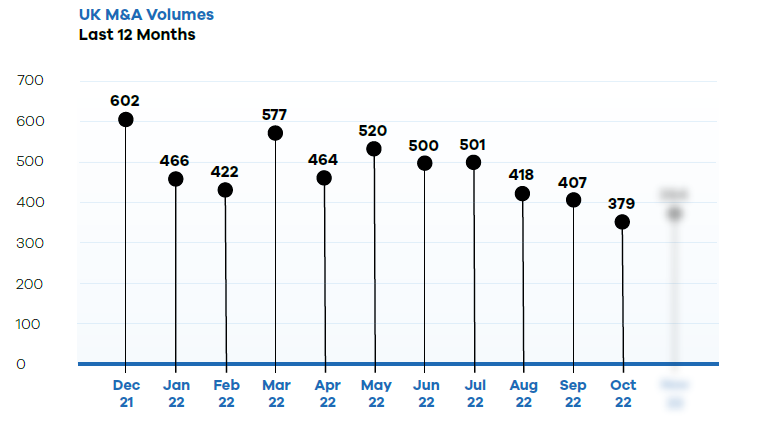

Deal volumes in November 2022 remained at a similar level to October 2022, but lower than the average volumes for 2022.

We combined data from MarktoMarket’s platform and our other sources to estimate the value of deals completed and announced in November 2022.

DEAL COMMENTARY

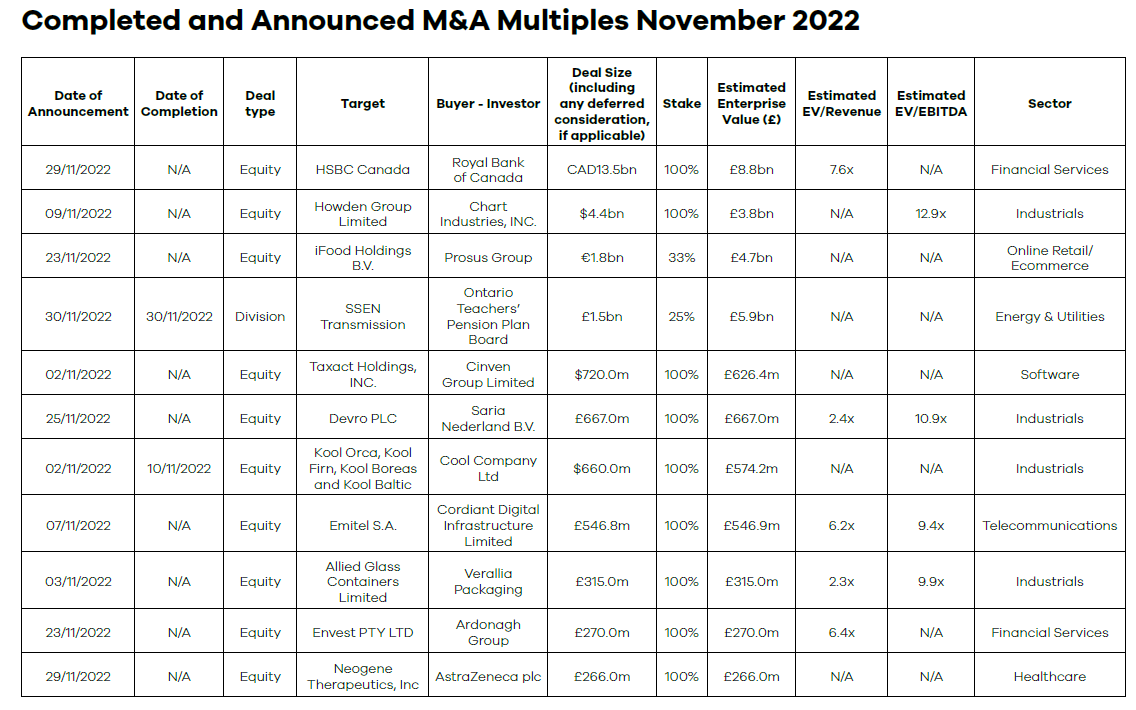

The largest deal in November was HSBC’s sale of its Canadian business to the Royal Bank of Canada for CAD$13.5 billion.

SPOTLIGHT TRANSACTIONS

Other deals during November included:

- Chart Industries acquired Howden for a consideration of $4.4 billion.

- Private equity firm Cinven has acquired TaxAct Holdings Inc for $720 million.

- Scottish-based Devro PLC, is being acquired by Saria Group for an enterprise value of £667 million.

The smaller end of the market witnessed the following deals:

- Renew Holdings PLC acquired Enisca Group Limited for £17 million.

- Swedencare AB acquired Custom Vet Products Limited for £10.6 million.

- The disposal of a 6% stake in Extrastaff at an estimated enterprise value of £12.6 million.

SAMPLE COMPLETED AND ANNOUNCED M&A MULTIPLES – November 2022

Request the executive report below. Please contact nick.webb@marktomarket.io to discuss access to the full list of deals in the MarktoMarket Valuation Barometers.

For the full list of previous 2021 / 2022 Barometers – visit our reports page.

Request the Report

Submit the form for the executive report.