Cross Border M&A: US buyers see fertile hunting ground amongst UK corporates

This article explores the behaviour of international mergers and acquisitions between the US and the UK. Using MarktoMarket data, we will determinewhat factors are most influential for US buyers of UK business; from significant relationships and exchange rates to company size and multiples, the lower-mid market seems to be the perfect hunting ground.

Special relationship

Winston Churchill coined the phrase “special relationship” in 1946. He was delivering his “Sinews of Peace” speech and was referring to the willingness of the UK and US to come to each other’s aid in times of conflict. The relationship remains deeply rooted in business and, as the two largest M&A markets in the world by deal volume and with a shared common language, it is no surprise that American businesses are the most prevalent overseas acquirers of British companies. The volume of domestic businesses bought by US companies is equal to the combined total attributed to acquirers from the Nordics, France, Germany, Ireland, Canada, Australia and Japan. In other words, the US is by some margin the most important cross-border market for the UK.

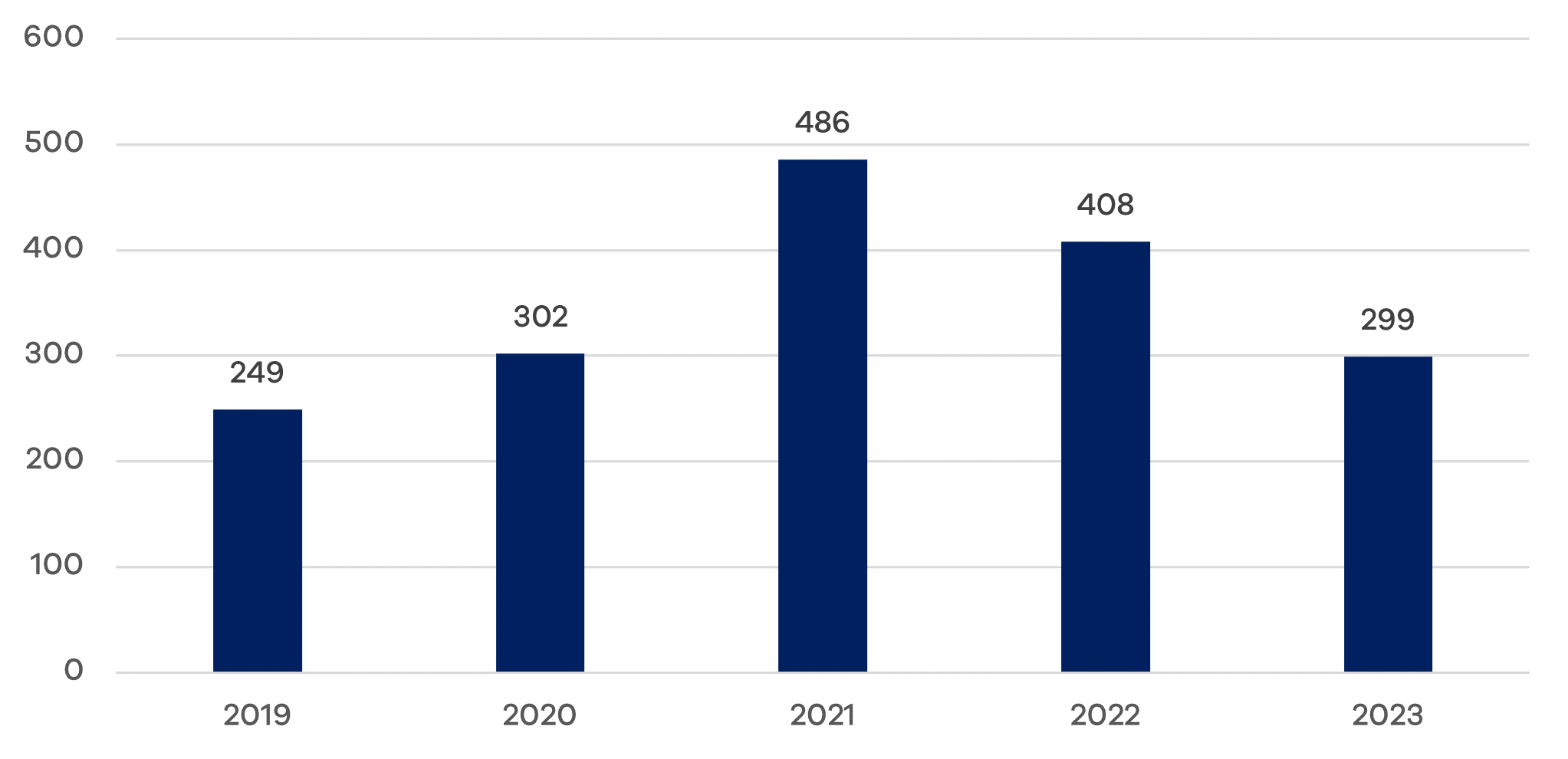

Figure 1: UK companies acquired by US-domiciled buyers.

Exchange rates

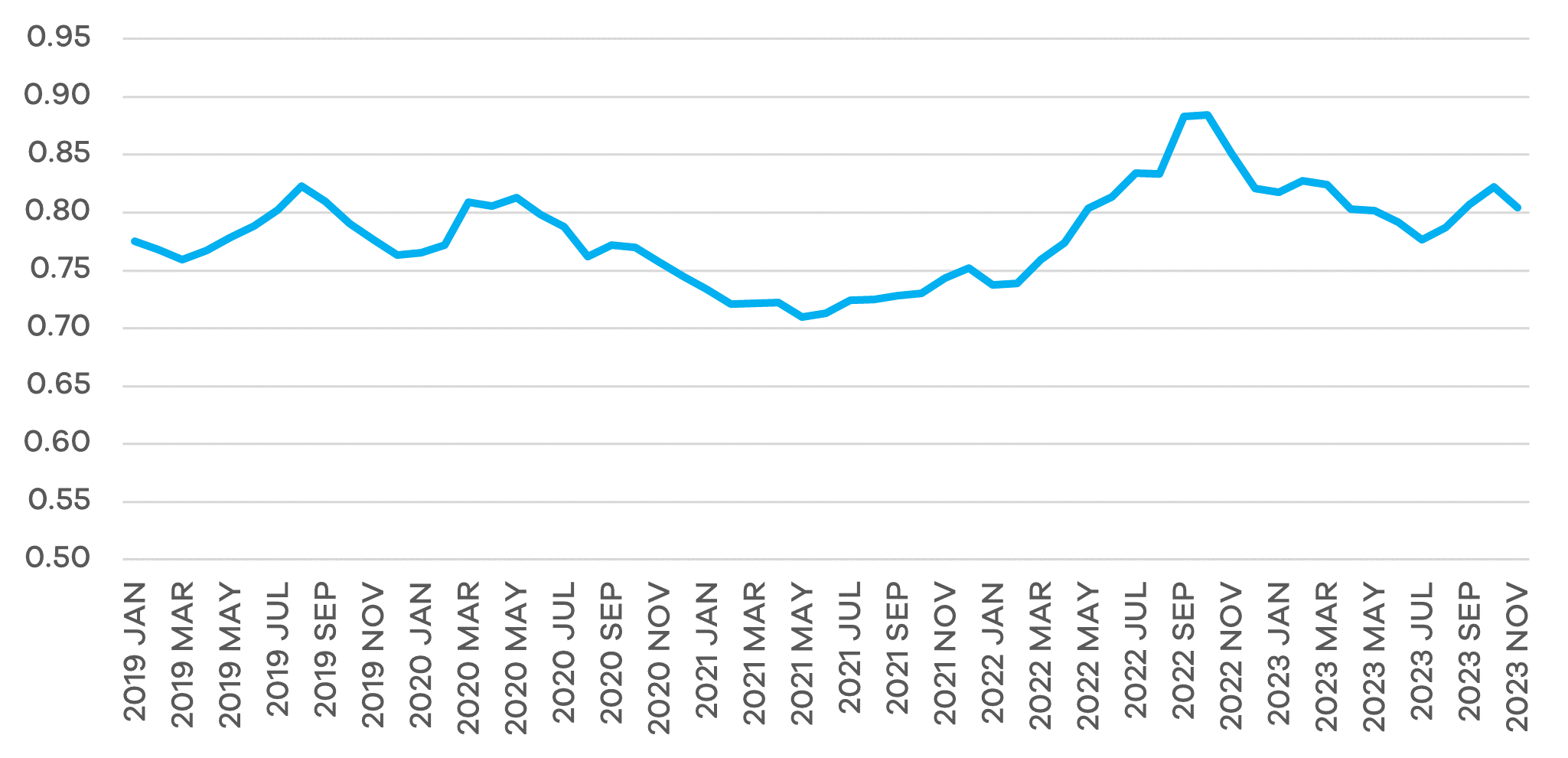

Since 2019, US acquirers have invested a total of £287 billion in UK businesses. The most active year for US/UK completions was 2021, which was a boom year for global M&A. This was, conversely, the 12 months when the Dollar/Sterling exchange rate was least favourable to US buyers. Observing the 5 year period under review, the Dollar peaked versus Sterling in 2022 at the same time as US buyers as a proportion of total acquirers of UK companies fell to 7.2% from 8.0% in 2021. This illustrates a decoupling of exchange rates from buyer interest and indicates other factors are at play, such as the de-rating of UK company multiples.

Figure 2: Dollar / Sterling exchange rate 2019-2023

Private equity

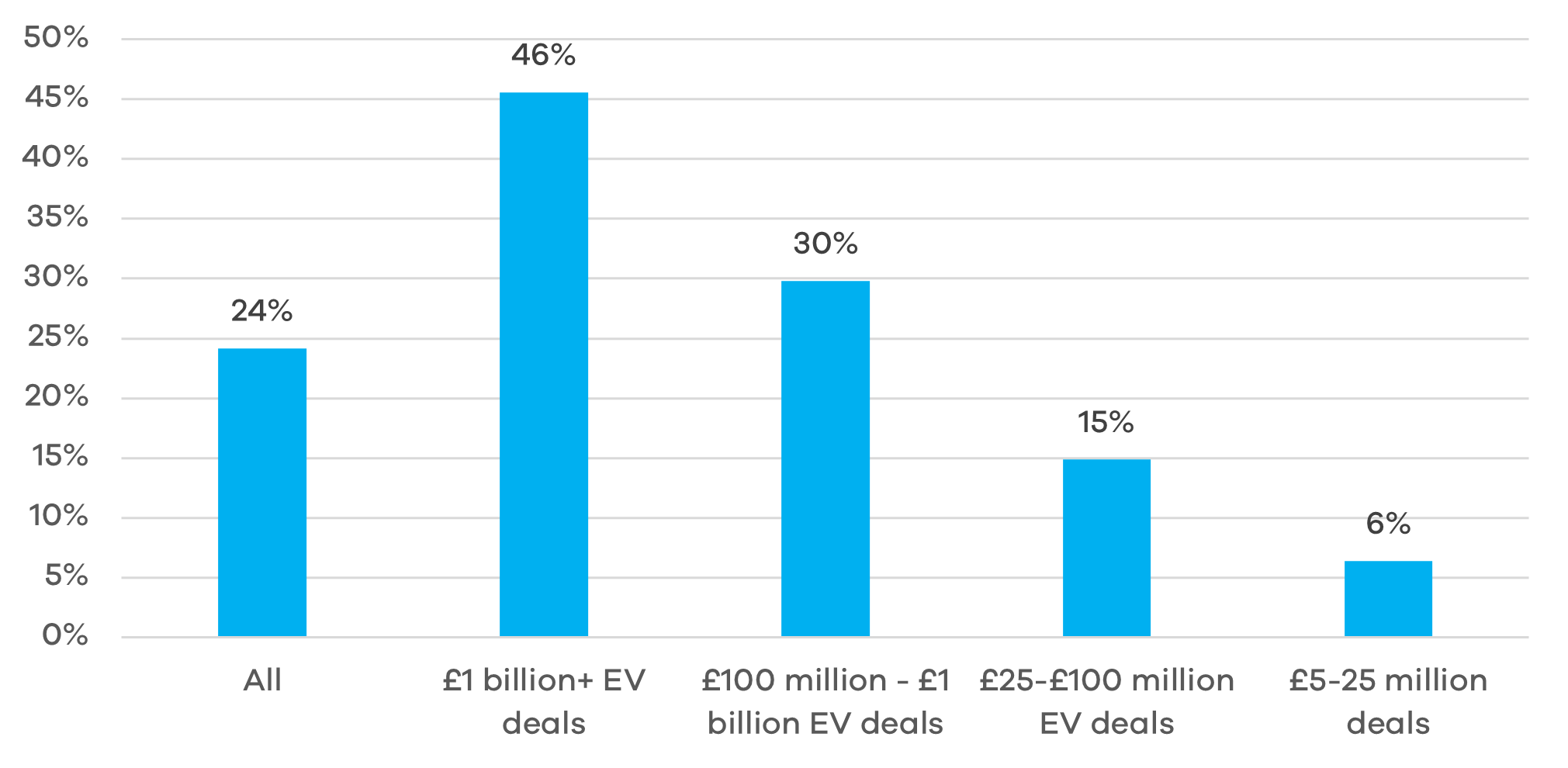

Our analysis of US acquirers of UK companies indicates that private equity interest is correlated to deal side. Segmenting deals into size brackets demonstrates that, whilst 46% of deals valued at over £1 billion featured a private equity firm on the buyside, only 6% of transactions in our £5-25 million category attracted a financial acquirer. Perhaps unsurprisingly, the US interest in smaller British businesses comes from strategic trade acquirers, not private equity.

Figure 3: Percentage of Private Equity buyers by deal size range 2019-2023

Multiple arbitrage

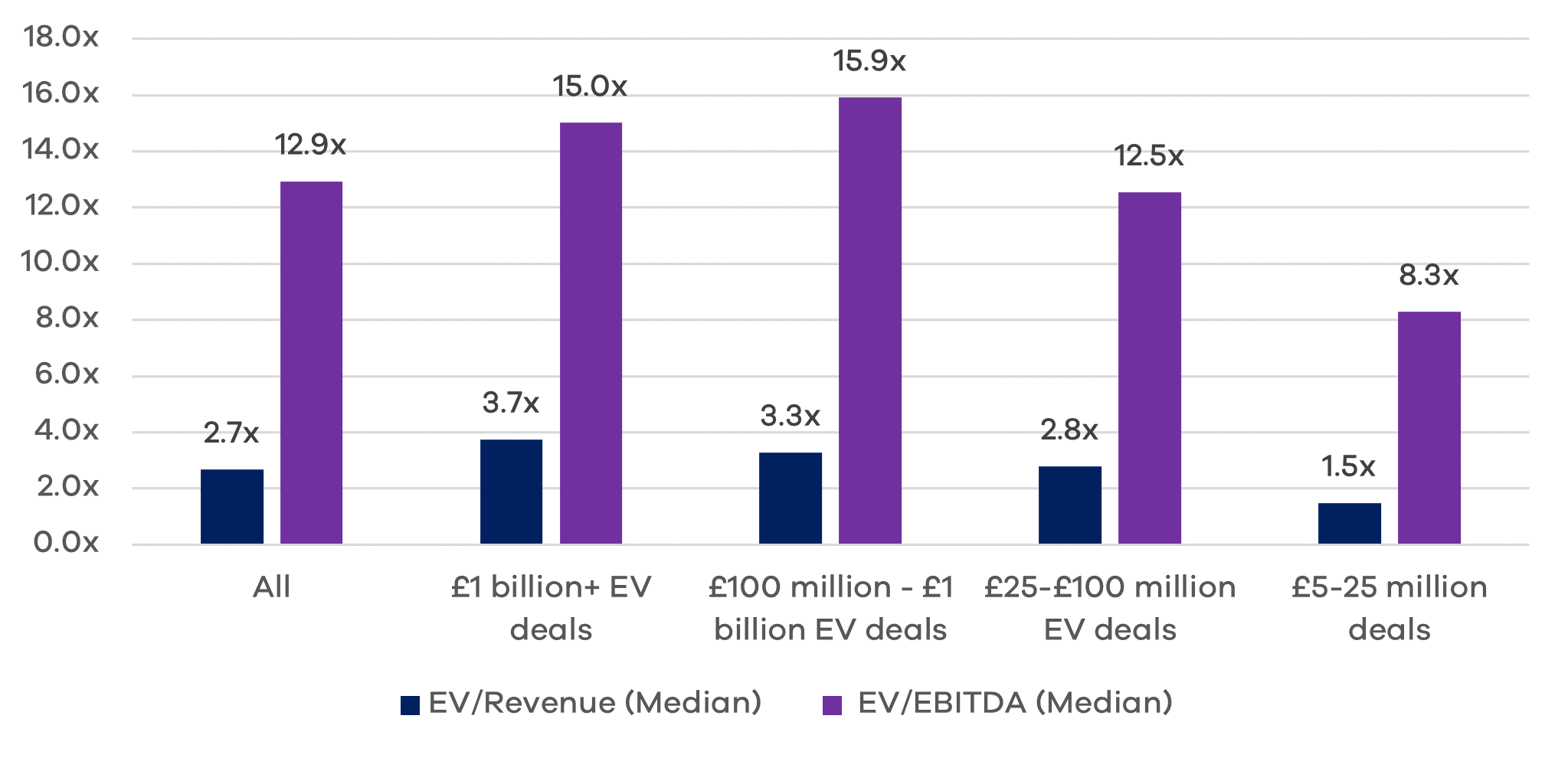

US public and private markets traditionally trade at a premium to their UK counterparts. This flows through to acquisition multiples paid for targets which indicate healthy prices.

Multiples expand materially as deal size increases with our £25-100 million enterprise value (EV) cohort averaging 12.5x EBITDA, a 51% premium to our £5-25 million EV cohort. Our data suggests an additional size premium for larger assets, with the £100 million to £1 billion sub-set reporting a median EBITDA multiple of 15.9x.

Figure 4: US/UK cross border M&A multiples by deal size range 2019-2023

Active lower mid-market

The headline grabbing deals include Belron, the vehicle repair group, which was acquired by Blackrock for £18 billion; IVC, the Bristol-based veterinary group, which received a €3.5 billion investment from Silver Lake Management; and Morrisons, the supermarket chain, which was the subject of a £10 billion takeover by Clayton, Dubilier & Rice. Whilst these mega transactions attract the headlines, the lower mid-market has been fruitful hunting ground for US corporate buyers. Recently we have seen the exit of Amdaris, a £27 million revenue digital transformation specialist, to Insight Enterprises, the Arizona-based systems integrator, for a total deal value (including deferred consideration) of $116 million; the £15 million (including assumption of debt and deferred consideration) sale of security printing specialist Cartor to Spectra Systems, the Rhode Island-based secure transaction technology group; and the acquisition of Data Interconnect, an accounts automation software developer, by Blackline for $11 million.

This activity in the SME, lower-mid and mid-market is a key reason why MarktoMarket is expanding its coverage of US M&A activity. Whilst we already hold details of thousands of US trade and private equity buyers on our platform, we are deepening our research into domestic American deals to surface more intelligence on deal values, multiples and buying patterns of US acquirers. This will help our customers identify and connect with high quality strategic and financial buyers on the other side of the Atlantic.

MARKTOMARKET

MarktoMarket is the most comprehensive data platform for the analysis of SMEs and startups. Our rich, auditable database of corporate information is used by thousands of the UK’s accountants, advisers and investors.

Please click here to find out more