AIMing in the wrong direction

The Alternative Investment Market (“AIM”) was created as London’s junior stock exchange, a viable alternative to raising capital privately. A stock market listing on AIM would be lower touch than a full list and would offer the advantages of liquidity, daily priced equity to incentivise staff and fast access to growth capital. Some superstar companies have listed and flourished on AIM – Fever Tree, ASOS and Boohoo are three recognisable names – although most are now suffering from the sell-off in jam tomorrow, high growth stocks. The AIM 50, representing the index’s largest stocks, is down 25% over the last year.

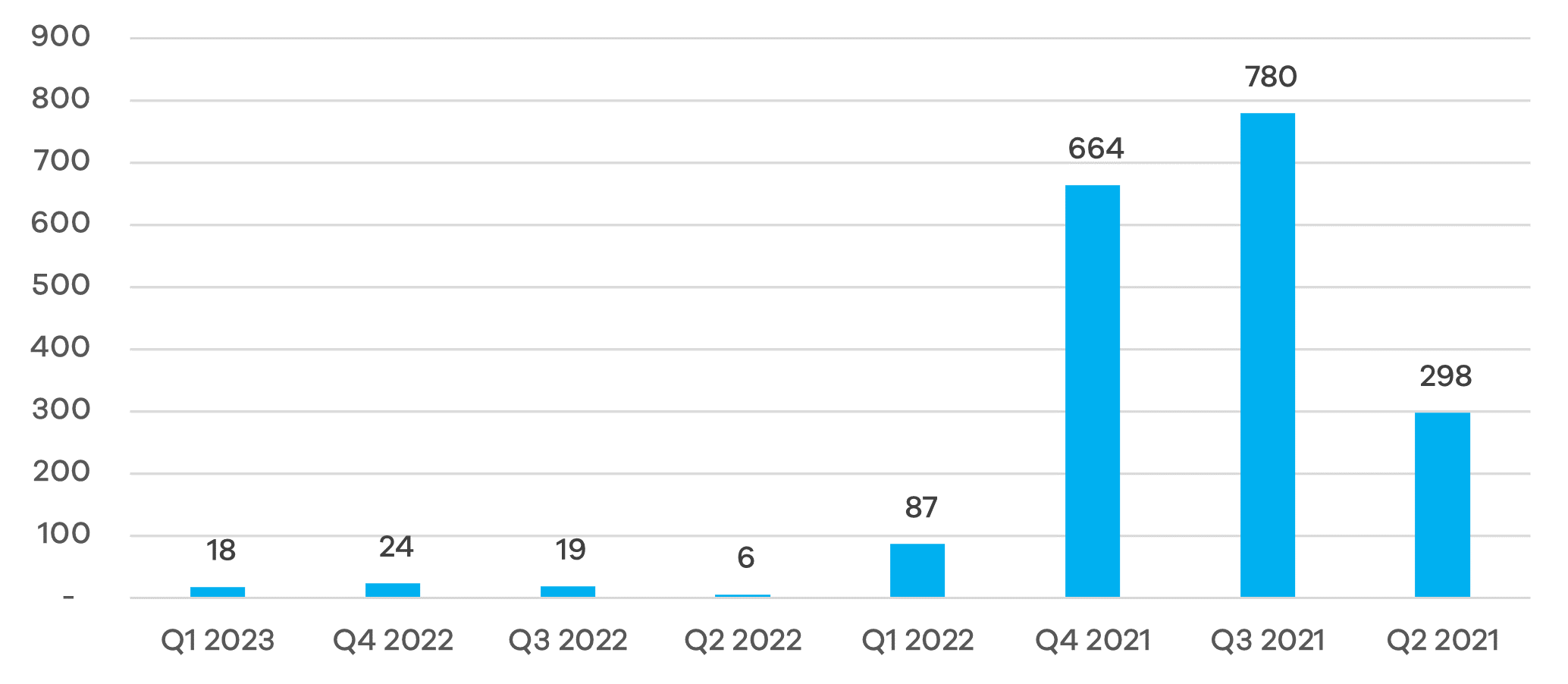

A better indicator of the health of AIM is how much capital is being raised and, by this measure, it doesn’t look great.

FTSE AIM: New money raised in last 8 quarters

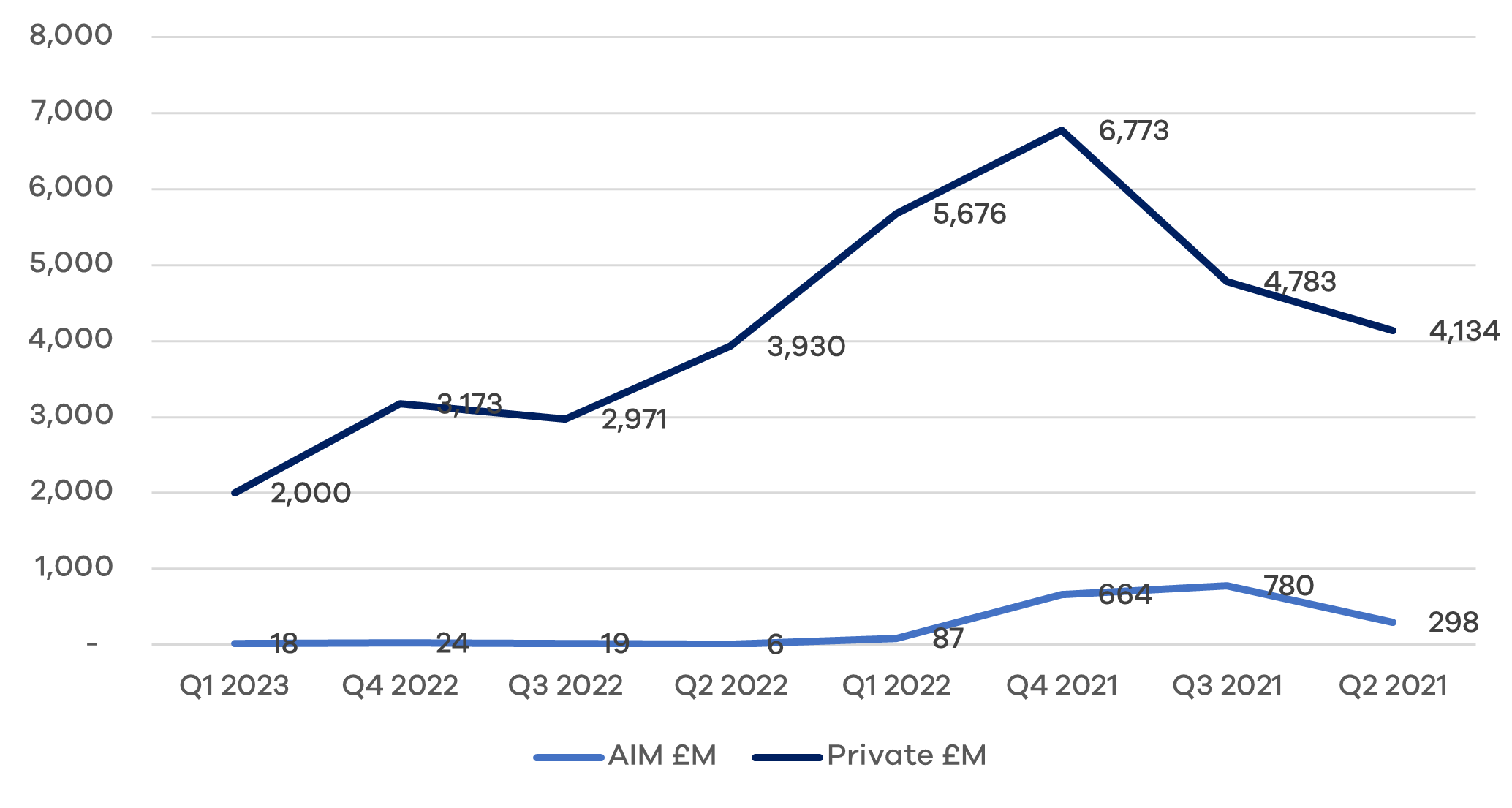

There are well-publicised reasons why the numbers are so lacklustre since Q1 2022, namely war in Ukraine, inflation and interest rate rises making earlier stage companies less attractive to investors. However, the private markets continue to function, albeit at subdued levels. The £1.9 billion of new money raised on AIM over the last eight quarters compares to £33.4 billion raised by UK private companies over the same period.

Private capital versus AIM: New money raised in last 8 quarters

It raises the question of whether this is a supply or a demand problem. The private market statistics demonstrate that there is a healthy pipeline of companies raising capital but there is either a reluctance of a lack of awareness about the public listing option. We see the problem as a combination of potential factors:

- Listing costs – most brokers will charge 5% of funds raised, which is in addition to legal, reporting accountant and other due diligence fees. It’s expensive.

- Listing process – the listing document (known as the “Admission Document”) is a detailed prospectus on the company which can run to over one hundred pages. Every statement must be checked by the legal team during a verification process. The listing company then undertakes a roadshow, meeting fund managers and analysts. It is time-consuming.

- Ongoing requirements for listed company – as well as producing interim and annual reports, which are released into the public domain for scrutiny by shareholders, potential shareholders, analysts and (probably) customers and suppliers, any material event at the company must be announced to the market. This means that any deviation from trading guidance must be flagged, any changes to senior management reported, and any discussions concerning corporate activity disclosed.

- Lack of current appetite – when public company investors don’t feel like investing, they don’t. Very few public equity funds operate in structures that require capital deployment over a set period of time. Most of the investment we see into private companies is coming from LP funds with a ten year life or EIS investments, which are driven by tax timing as well as commercial considerations.

- Pension requirements – the ability to meet pension liabilities as they fall due drives a conservation approach to asset allocation. It means that pension funds will rotate out of equities, particularly risky growth equities will no yield, into income producing assets perceived as safe such as Gilts and US Treasuries. This reduces overall demand for earlier stage investments in pension funds.

If this is the case, why would you both considering a listing on AIM?

- Access to capital – once the torture of achieving a listing has been overcome, a company has quick access to further rounds of funding. The public markets function efficiently when a listed company wants to do a top-up raise for growth or acquisitions.

- Professionalism – the regulations impose discipline, from constructing an independent board to regular and robust reporting. This may seem arduous but is likely to enforce positive behaviours and increase credibility.

- Liquidity – subject to rules around close periods, founders and employee shareholders have a liquid market in which to value their position in the company and trade shares. Trading shares in private companies is complex and cumbersome.

MARKTOMARKET

MarktoMarket collects rich data on private businesses, particularly in the small and mid-market. Our easily searchable database allows our advisory, private equity and corporate customers to identify, analyse and price investments.

MarktoMarket’s auditable data gives users the confidence that they are dealing with intelligence that can be trusted

To continue the discussions about how data can support your business, contact Olga Melnyk at olga@marktomarket.io.