January 2022 Valuation Barometer

Overview

Highlights from our January 2022 Valuation Barometer, covering deals and valuation multiples in UK M&A in December 2021. Request the Executive Summary below.

Highlights

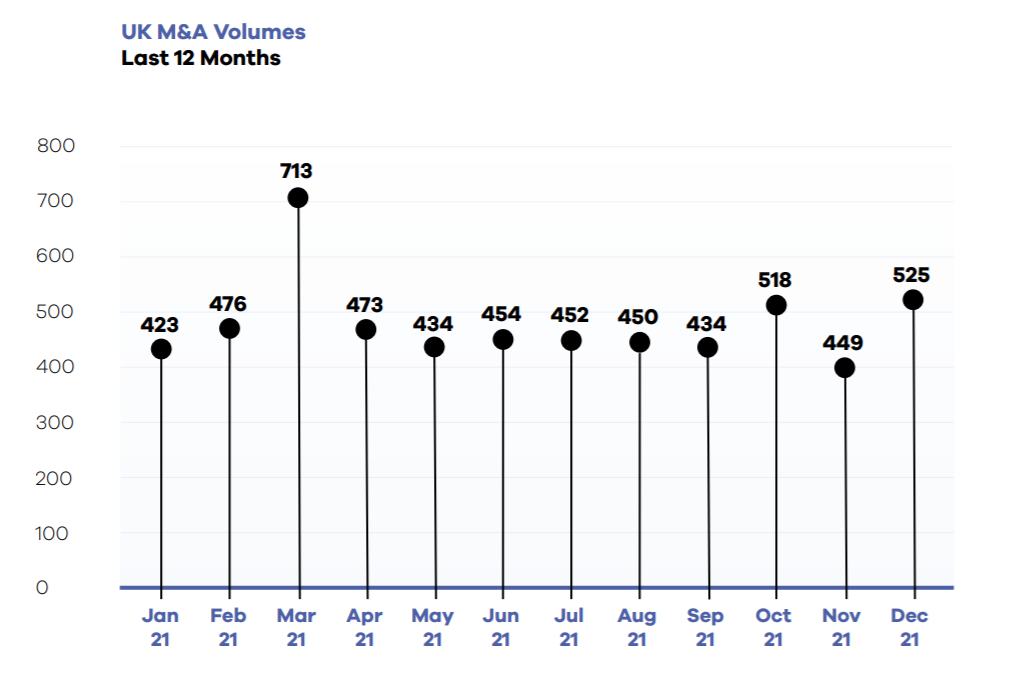

Deal volumes increased in December 2021 to 525, which represents the second highest month of deal activity in 2021.

We calculated that M&A deals valued at a total of £25.7 billion were executed or announced during the month of December. This compares to a prior month’s total of £17.1 billion.

dEAL cOMMENTARY

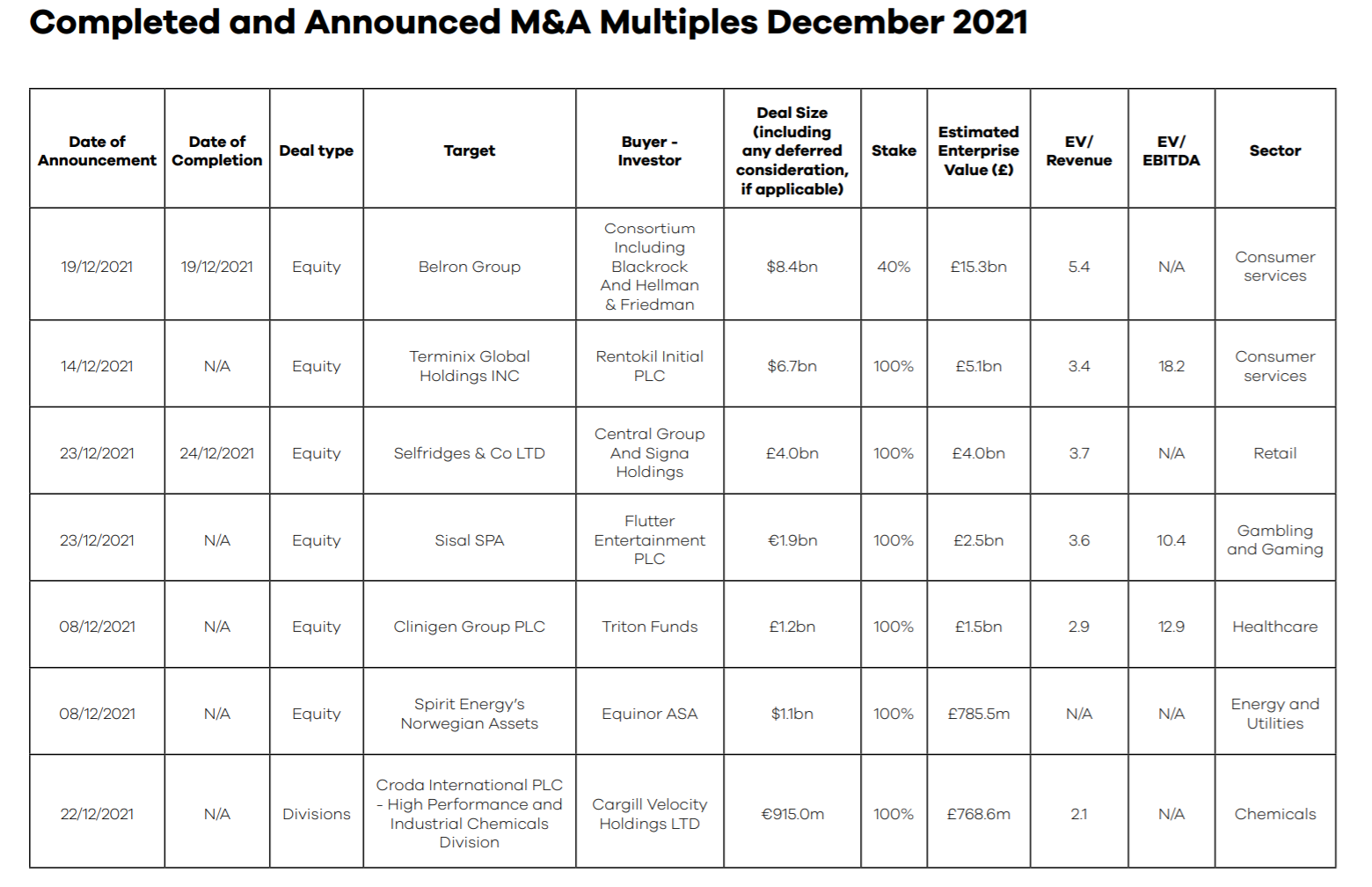

The largest deal of the month was the disposal of Clayton, Dubilier and Rice’s (“CD&R”) 40% stake in global vehicle glass repair and replacement business Belron for €8.4 billion.

The deal values Belron at €21 billion, a significant increase since February 2018, when CD&R

acquired the position at an estimated enterprise value of €3 billion.

Spotlight Transactions

Other deals during December included:

- Rentokil Initial PLC’s acquisition of fellow pest control group Terminix Global Holdings Inc for $6.7 billion.

- Central Group’s and Signa Holdings’ acquisition of Selfridges Group from the Weston Family for £4 billion.

- CVC Capital Partners’ sale of Sisal Gaming to Flutter Entertainment for €1.9 billion.

The smaller end of the market witnessed the following deals:

- Capita PLC’s disposal of its AMT Sybex software business to Jonas Computing (UK) Limited in a deal valuing AMT Sybex at £40 million.

- Savage & Whitten Holdings Limited’s sale of a 36% stake at an estimated enterprise value of

£16.6 million. - The acquisition of Inclusive Learning Limited by Marlowe PLC for a consideration of £8.0 million.

SAMPLE COMPLETED AND ANNOUNCED m&a MULTIPLES – December 2021

Request the executive report below. Please contact olga@marktomarket.io to discuss access to the full list of deals in the MarktoMarket Valuation Barometers.

For the full list of previous 2020 / 2021 Barometers – visit our reports page.

Request the December 2021 Barometer Executive Report

Submit the form for the executive report.