June 2021 Valuation Barometer

Overview

Highlights from our June ’21 Valuation Barometer, covering deals and valuation multiples in UK M&A in May 2021. Request the Executive Summary below.

Highlights

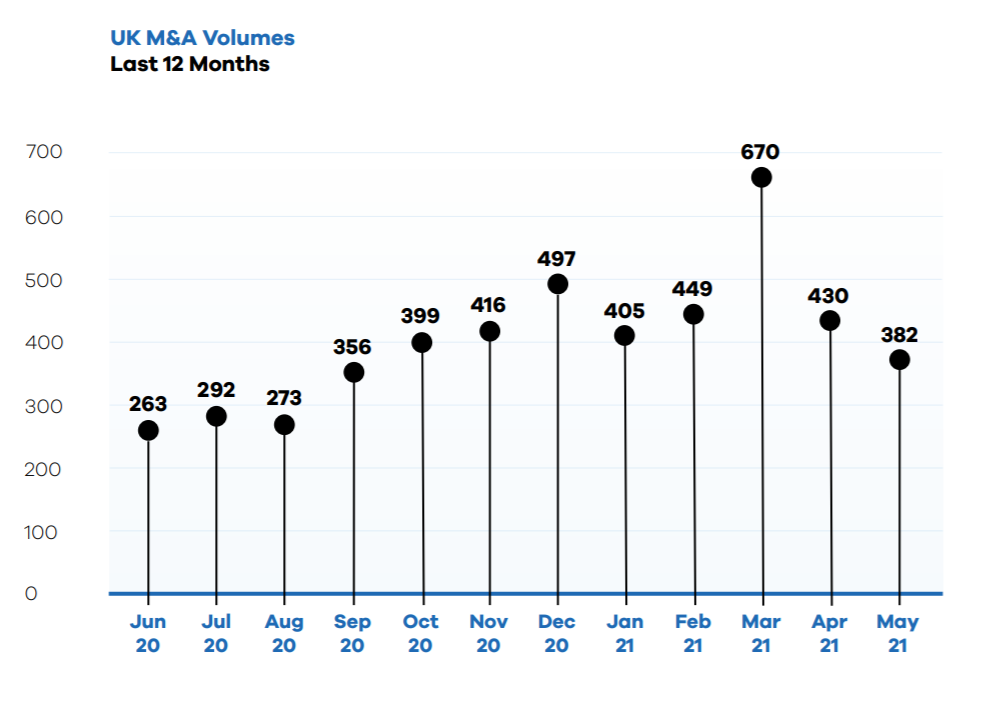

MarktoMarket’s latest data indicates a continuation of the ‘return to normal’ levels of activity in UK M&A markets following elevated deal volumes in the first quarter of 2021.

The total value of deals completed in May grew by 80% to £22.5 billion from £12.5 billion in April, despite the number of transactions over £1 billion falling from nine to six.

dEAL cOMMENTARY

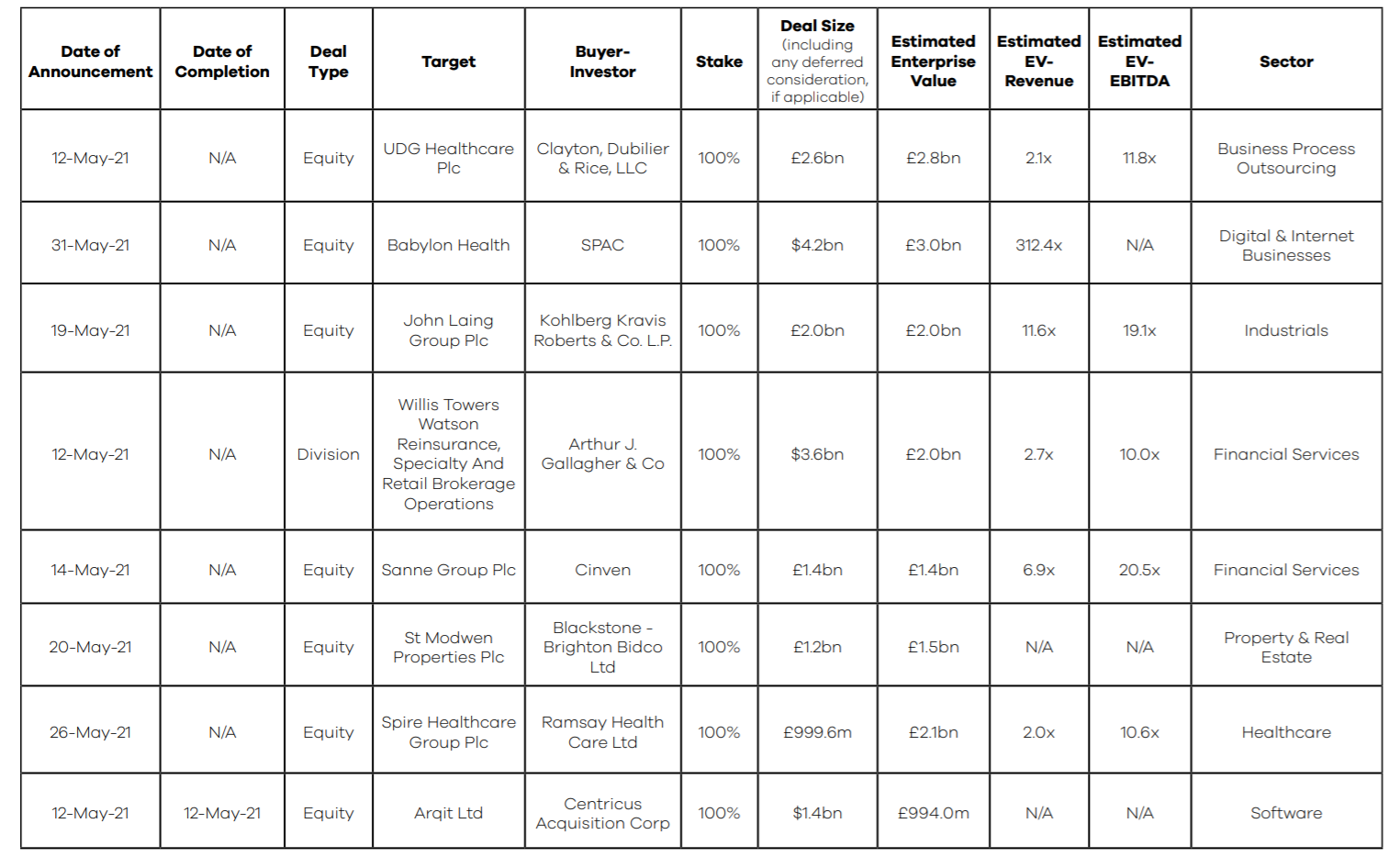

Coinciding with the pick-up in IPO activity has been the corollary – buyer interest in UK plcs from private equity. UDG Healthcare (Clayton, Dubilier & Rice), John Laing (KKR), Sanne Group (Cinven) and St Modwen (Blackstone) were amongst the recipients of bids from buyout firms.

Spotlight Transactions

Other deals during May included:

- KKR’s acquisition of a majority stake in ERM, a deal that values the sustainability consultancy at $3 billion

- Ramsay Health Care Ltd’s acquisition of 100% of stakes in Spire Healthcare Group for just under £1 billion

- Centricus Acquisition Corp’s buyout of Arquit Ltd for $1.4 billion

The smaller end of the market witnessed the following deals:

- The $20 million acquisition of property transaction software specialist Terrafirma IDC by US

legal solutions provider Dye & Durham - The sale of cannabis wellness business Ciitech to Fragrant Prosperity for £17.5 million

- The acquisition of a 10% stake in Timothy Taylor, brewer of the eponymous beer, for £2.5 million

sAMPLE COMPLETED AND ANNOUNCED m&a MULTIPLES – may 2021

Request the executive report below. Please contact olga@marktomarket.io to discuss access to the full list of deals in the MarktoMarket Valuation Barometers.

For the full list of previous 2020 / 2021 Barometers – visit our reports page.

Request the June 2021 Barometer

Submit the form for the executive report.