February 2021 Valuation Barometer

Overview

Highlights from our February ’21 Valuation Barometer, covering deals and valuation multiples in UK M&A in January 2021. Request the report below.

Highlights

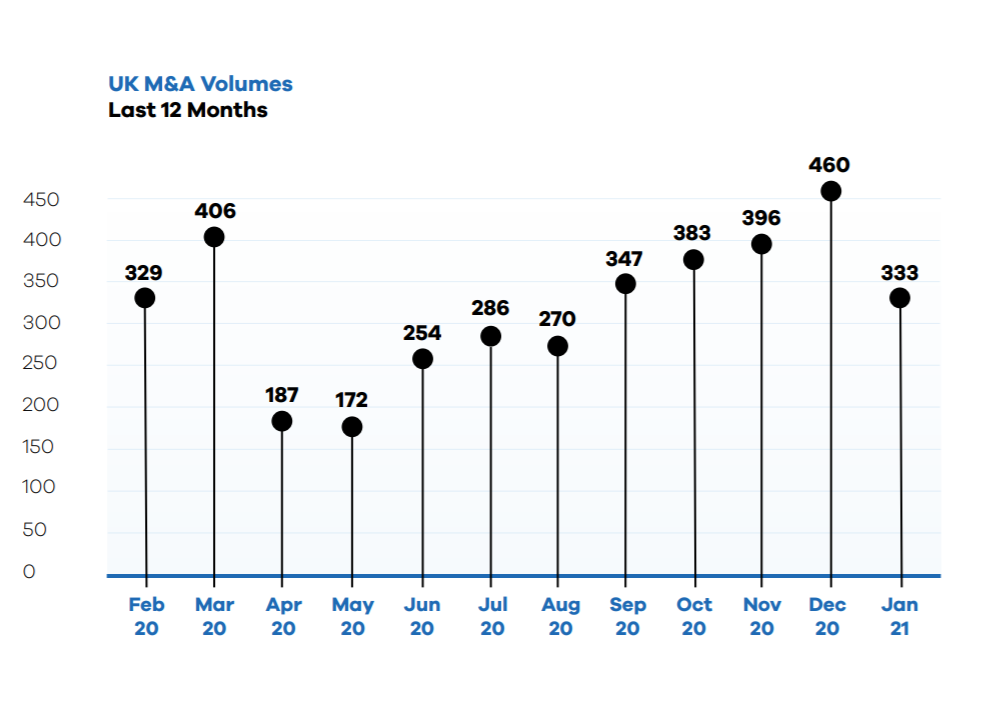

Deal announcements and completions in January were down on a spectacularly buoyant December 2020. A total of 333 M&A transactions were recorded in January (28% lower than December).

The property sector saw further consolidation with the acquisition of Hunters Property by TPFG and the merger of Lomond Capital and Linley & Simpson. Wealth management continued to be the focus of buyer attention with Flexpoint Ford’s bid for AFH Financial and the takeover of Oberton by Baskerville Capital.

We calculated that M&A deals valued at a total of £33.3 billion were executed or announced during the month, 43% down on December 2020.

dEAL cOMMENTARY

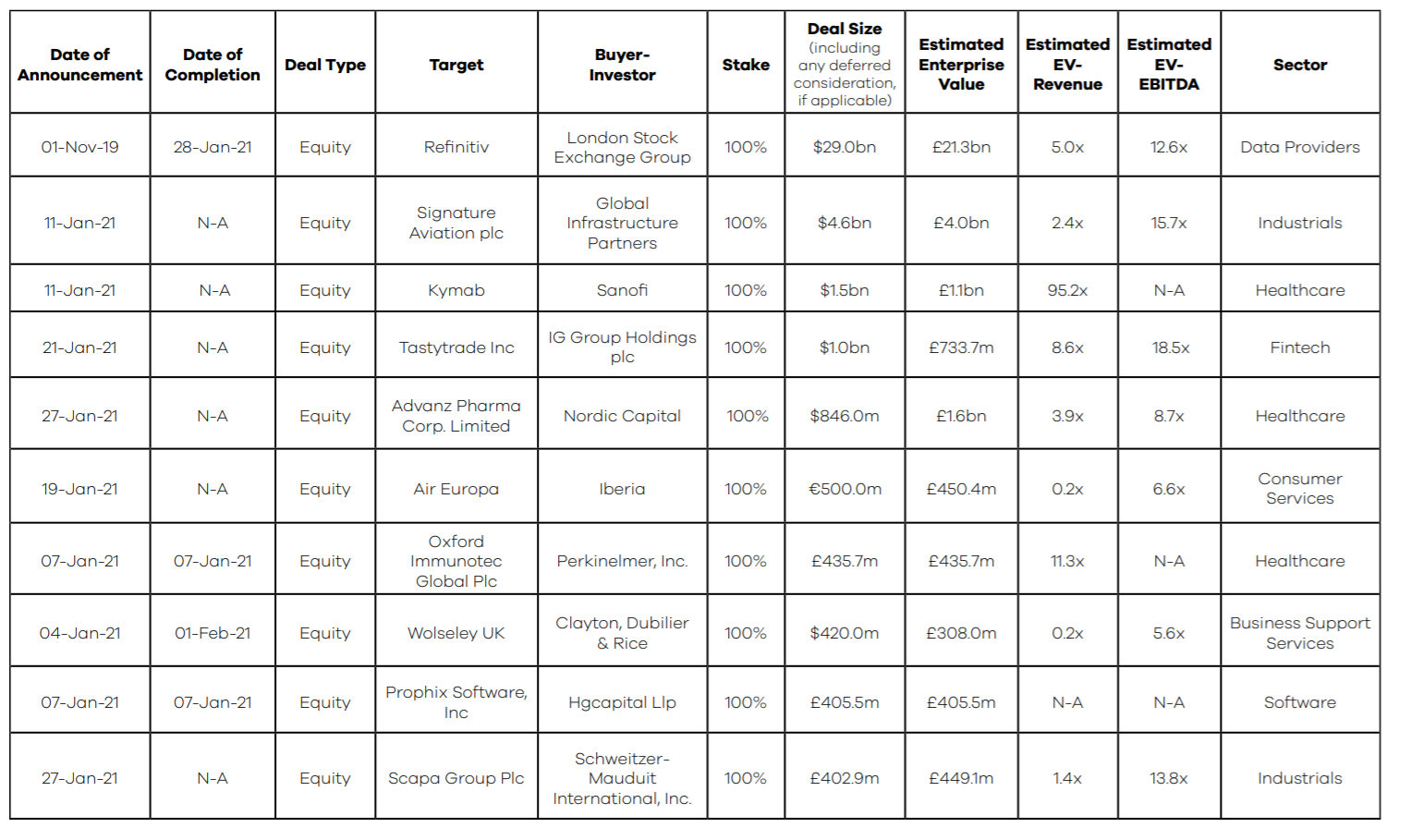

The aggregate deal value was dominated by the London Stock Exchange’s $27 billion acquisition of Refinitiv from Thomson Reuters. The next most significant deal by value was the proposed takeover of Signature Aviation by Blackstone and Global Infrastructure Partners for $4.6 billion. The bid for Signature is a vote of confidence in the aviation sector by two of the world’s leading private equity and infrastructure investors.

Spotlight Transactions

Other deals during January included:

- Sanofi’s $1.45 billion acquisition of Kymab, a clinical-stage biopharmaceutical company developing fully human monoclonal antibodies with a focus on immunemediated diseases and immunooncology therapeutics

- The $1 billion acquisition of Tastytrade Inc, an online brokerage, by IG Group

- Nordic Capital’s $846 million takeover of ADVANZ PHARMA Corp, a speciality pharma company with a focus on complex medicines

The smaller end of the market witnessed the following deals:

- The $11m acquisition of Jet East, an aircraft maintenance specialist, by Gama Aviation

- The £50 million acquisition of EQi, a retail investment platform, by Interactive Investor

- Genius Group’s $15 million acquisition of investment education platform Property Investors Network

sAMPLE COMPLETED AND ANNOUNCED m&a MULTIPLES – january 2021

Request the executive report below. Please contact olga@marktomarket.io to discuss access to the full list of deals in the MarktoMarket Valuation Barometers.

For the full list of previous 2020 / 2021 Barometers – visit our reports page.

Request the February 2021 Barometer

Submit the form for the executive report.